Big Data Strategy – From Customer Targeting to Customer Centric

Big Data Strategy – From Customer Targeting to Customer Centric

By Patrick Maes, CTO and GM Strategy & Planning, Global Technology Services and Operations, Australia & New Zealand Banking Group

“Would you like Fries with that?” We have all heard the phrase pioneered by a certain fast food chain – it’s called suggestive selling and has been hugely successful in increasing sales and revenue for that organisation.

Of course, behind this approach there was not a lot of data or analytics – nor did there need to be – but there was a key insight in understanding the power of suggestion at the point of sale. In a more complex environment and for higher involvement products and services, this has evolved to ‘cross-sell’, ‘up-sell’, and ‘next-best-product’ conversations driven by the improvements in data and analytical capabilities. It is this concept that I will explore and challenge.

Current State Analytics

Analytics has been around for many years. In fact, I started my career using analytics and artificial intelligence to underpin AXA’s ambition to become “La banque de conseil” (the advisory bank”) 25 years ago. While the algorithms we used in the eighties were pretty advanced, the main difference between now and then is we didn’t have the computing power we have now and of course the data sets are far larger now due to the digitization of our society.

We read a lot now about ‘the Big Data promise’. The hypothesis made is pretty simple: we can use analytics on this data to provide deeper insights about our customers (such as aspirations, preferences, propensities, etc.) that will enable us to serve our customers better and create a positive effect on their well-being.

However, the majority of companies seem to be using this technology in a very shallow way to just find ways to sell more of their products (or services) to their customers, or find new customers — what we in the industry call ‘cross-sell’, ‘up-sell’, and ‘next-best-product’. This approach is equally applicable to the world of financial services.

While this leads to a degree of commercial success, using analytics to be better at selling is not enough to give you an edge as everyone is getting into this sort of thing, and it doesn’t create a competitive advantage in a sustainable way. In fact the mass usage of “simple” analytics or what I call “McDonald’s Analytics” will only bombard people with a massive amount of offers with very little sophistication, and will result in a new generation of spam, similar to the printed advertisements that caused an overflow of our post boxes in the nineties…let’s call it ‘digital junk mail”.

Big Data and Analytics will only provide a better outcome if we move away from the pure transactional dimension to a customer centric approach.

The five building blocks of Customer Centric Analytics

A lot of bank technology in recent years has been dedicated to products and services which were about ‘empowering’ the customer, especially through digital channels. But many of these were standalone offerings built from individual elements in isolation, creating an often inconsistent and confusing experience for the customer. For consistent user experience there is an urgent need to bring them together.

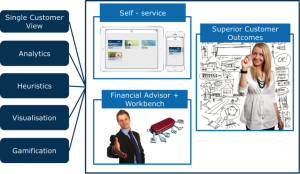

Data and analytics are crucial here. The model below outlines the five key components that I believe are required to offer a truly customer-centred approach.

The Single Customer View is the key building block in any analytical capability. The most basic start in Data is to consolidate all your current structured customer data and create that single customer view. Nothing fancy, just a bit of master data management (matching) and data clean-up – boring, but very necessary. We are all aware of the “annoying” experience of the next great offer ‘empowered by analytics’, when we already have the product or it is not relevant to us.

Once you have this in place, you can enter the world of analytics, not the cheap ‘McDonald’s’ versions (often just correlation engines) that almost any technology and data company can offer you, but advanced modelling techniques such as Baysian networks. The key here is to find the data scientists that can work with these models, a skill not easy to find nowadays.

Imagine you have found a great analytical outcome; the next step is to explain this in the context of your business. For instance, A strong possible correlation between the success of Justin Bieber and the decline of the US economy post GFC is interesting, but useless if you can’t explain it. This highlights the importance of heuristics and common sense which compliments the analytical approach to data, and the introduction of self-learning technologies found in cognitive machines such as Watson (IBM).

Complementary to this artificial intelligence, the human brain can process complex data from visual stimuli and identify patterns far quicker and more accurately than computers are currently able to do. This means that data visualisation, when done well (e.g. multi-dimensional), adds significant value in the speed and accuracy of decision making and sometimes provides more insight than pure analytical data crunching.

Last but not least, we humans like to play. Gamification technology allows us to explore scenarios in a “fail safe and fail fast” environment. Gamification can help you to take all this insight created from previous capabilities and bundle them all together in a compelling, engaging and fun interaction. That’s exactly what Big Data should be about.

Customer Centred Analytics – a new approach

This brings me back to the real value of improvements in data and analytical capabilities.

We all know that most banking products are commodities with very little room for differentiation. We can either be the trendy, social media obsessed, product bank that, after exhausting all (often defensive) marketing options, will probably end up differentiating on price. Or we can be the intelligent, customer centric organisation that looks further than products and wants to play an important role in helping people and companies to succeed.

When we complement our data sets with discovery and learning, we shift from products and services to value-adding advice, creating better outcomes for our clients and ultimately better results for our businesses – or in the words of Jack Byrnes (Robert De Niro in Meet the Parents) we can be “in the circle of Trust”.

Patrick Maes